KuCoin Tutorial for Beginners

KuCoin is an exchange for all types of investors, so if you’re new to the area, here’s a beginner’s guide that will show you the entire process, from registration to trading on the platform.

To get started, you first need to register with the exchange. You can do this in two ways, by e-mail or phone number. See here how to perform the registration step by step. Make sure you use the referral code in this process.

After registration, it is important to protect your account and assets, so we recommend that you set your security settings and do KYC verification (identity verification). KYC verification will also be required to perform transactions on the platform.

Once this is done, there are two ways to then start trading: deposit funds (currency or cryptocurrency) or buy cryptos directly with a card. Let’s take a look at them one by one:

Depositing cryptos on KuCoin

If you already have cryptocurrencies, you can transfer them to the platform. To do this, you must first click on the wallet icon in the header and Deposit.

Then, on the Deposit tab, select the currency you will transfer and the network. Then copy your deposit address and paste it into the withdrawal platform (from where you are transferring).

ATTENTION: take care that the currency and network selected match the network of the address you entered.

KuCoin does not charge any fees for deposits, and they can take from minutes to hours, depending on the currency, to be processed. It is important to check which currencies are supported by the platform, and also that all the information (token, address, memo, tag, message) is entered correctly, otherwise these assets cannot be retrieved.

Depositing coins on KuCoin

If you do not yet own any cryptocurrency, you can make fiat currency deposits directly into KuCoin or via third-party payment gateways.

To do so, you must first click on the wallet icon in the header and Deposit. Then, on the Deposit tab, click on the Deposit Fiat button and fill in with your preferred currency and the available payment method.

Buying cryptos on KuCoin

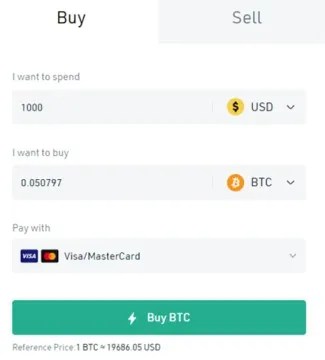

There are three ways to buy cryptos directly on Kucoin: Fast Trade, P2P and Third-Party.

Fast Trade: fast purchase with credit or debit card. See step-by-step here

P2P: peeer-to-peer purchase through various payment methods, such as BANK, Payeer, AirTM, Advcash, Uphold and others. In this method you choose an advertiser that is selling the cryptocurrency you want to buy and select one of the available payment methods.

Third-Party: buying through third-party gateways, such as Simplex and Banxa.

Trading cryptos at KuCoin

With the balance in your account, it’s time for trading. For starters, most start with spot trading, crypto-to-crypto. For advanced trades, there are the options of Margin Trading and Futures Trading.

As the idea here is to show beginners how to trade on the platform, we will show you step by step how to make a spot trade.

In the Trade menu, select the Spot Trading option.

Select the crypto pair you want to trade. In the example below we have selected to trade KCS for BTC.

Then choose the order type and fill in the corresponding fields. KuCoin’s buy and sell order options are Limit, Market, Stop Limit and Stop Market.

But first, you will need to enter your transaction password, created there in the security settings.

In the Limit order you will set a limit price (usually below the current market value) to buy or sell your cryptos. In the Market order, you buy or sell at the best current market price. And in the Stop Limit order you set a trigger price to buy or sell your cryptos at the set limit price. Still another option is the Stop Market order, where you set the trigger price to buy or sell your cryptos at the current market price.

Each coin has a minimum value for trading, and fees start at 0.1%, but can be decreased by maintaining KCS or increasing trading volume.

Making cryptocurrency withdrawals at KuCoin

Just like depositing cryptos, withdrawing cryptos at KuCoin is very simple.

Click on the wallet icon in the header and Deposit.

On the Withdraw tab you will have the Withdraw Crypto and Withdraw Fiat options. Choose where you want to withdraw your funds from and fill in the corresponding fields, always paying attention to the correct typing of the information.

And to confirm the deposit and withdrawal balance, click on the History tab (Deposit & Withdrawal).

Other KuCoin functionalities

Navigating through the platform menus, we see that it is also possible to perform transactions in Markets.

In the All tab it is possible to view the current values of cryptocurrencies and also perform actions buy call and put options in the Spot tab.

Other trading options in the Trade menu, besides the one mentioned above (Spot Trading) are Margin Trading, Trading Bot and Convert. These trading markets, while they can amplify your profit, can also expose you to increased risk.

In margin trading the method is to use third-party funds to trade assets, as if it were a loan. One advantage is that it allows you to increase your main fund and use small funds as collateral to make more profit. However, the higher the leverage, the greater the losses, and it is therefore considered a high-risk investment.

With Trading Bot you can set up a trading strategy and this free tool will repeat it constantly. This way you save time and energy and increase your profit by reducing trading risks.

And finally, there is the Convert option, which is nothing more than a free tool for converting cryptos to other cryptos, without the need for spot market trading.

In the Derivatives menu are the options for futures trading. Simply put, here you will be buying assets at a later date with a predetermined price at a also specified time, and the seller will have to make delivery of this asset under these conditions on this same date.

In the Earn menu you will find KuCoin tools that will allow you to earn passive income. Learn more about KuCoin Earn by clicking here

In the NFT menu you will find options of NFT tokens for trading.

And finally, in the Wallet menu you will have access to the official KuCoin wallet, where you can send, receive and store your cryptocurrencies and NFTs.

If you liked this article, you might also be interested in: